The Department of Homeland Security (DHS) earned

an honorable mention in the 2023 Scorecard. Over the

last 5 years, PSC has given consistently high marks to DHS components’ forecasts. Unifying DHS components under

a single Acquisition Planning Forecast System (APFS)

has helped improve the quality and consistency of DHS forecasts across the board. PSC commends DHS for providing frequent updates to this system as well as incorporating a transparent log of updates to individual opportunities within APFS. We encourage DHS to

continue this positive trajectory by including more comprehensive descriptions of forecasted opportunities within their website.

Needs Improvement: USDA

Over the last 5 years of assessing forecasts, PSC has determined that U.S. Department of Agriculture’s (USDA’s) operating divisions have several areas for improvement. Considering that USDA spends a significant portion of its budgets on contracted goods and services, PSC encourages the Department to provide a more frequently updated, detailed procurement forecast, including but not limited to a “date modified” column of information for each opportunity. Additionally, the USDA could benefit greatly by increased engagement with contractors, and PSC, on ways to improve its forecast; such outreach would highlight the importance of more detailed information about anticipated award dates and length, contract vehicle information, program buying office, and award type so

that USDA could better access needed capabilities from their contracting partners.

How Does Industry Use Business Forecasts?

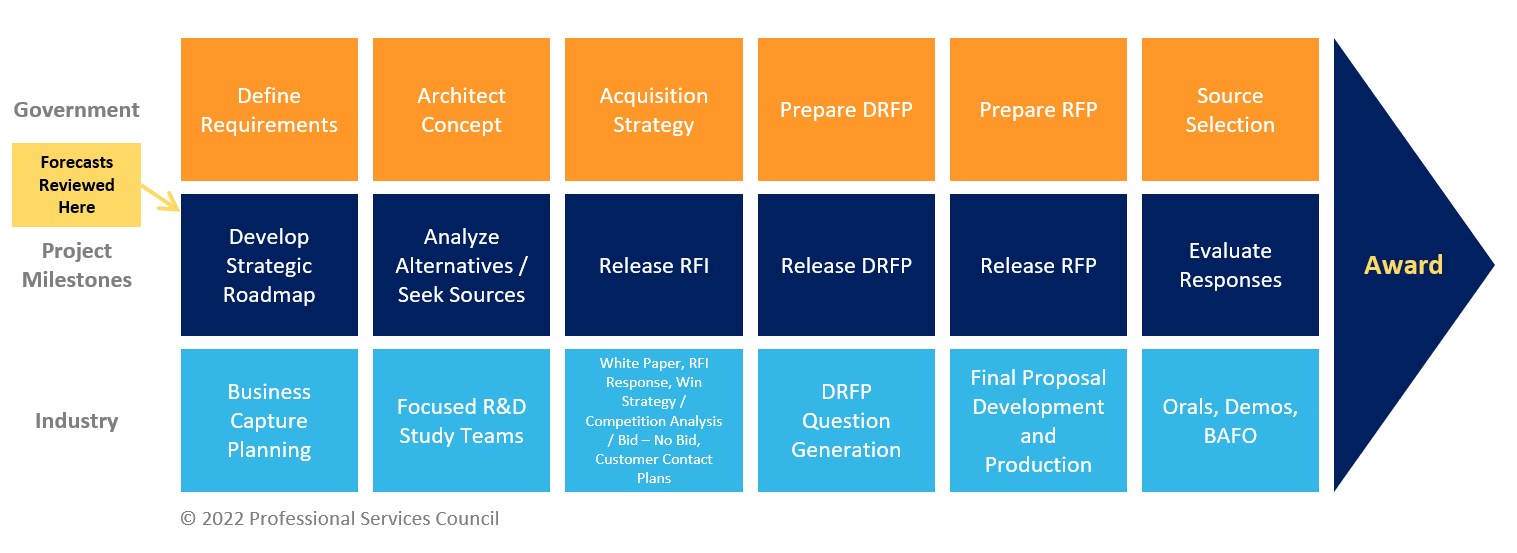

To provide federal customers with more timely, comprehensive, and thoroughly researched solutions when final Requests for Proposals (RFPs) are released, companies rely on the accuracy, comprehensiveness, and timeliness of an agency’s business forecast, especially though not limited to the publicly available website.

Often, resource allocation and teaming decisions are made well in advance of the RFP release. A useful forecast provides excellent, actionable information that can enable interested entities to determine potential staffing requirements, project needs, and costs. While PSC and the services contracting community fully recognize that spending priorities often change on short notice, significant course corrections tend to be the exceptions rather than the rule in the services sector.

Scorecard Methodology

Due to the number of agencies and subcomponents tracked and to be as objective

as possible, PSC staff take a “snapshot” of agencies’ web-based forecasts at the beginning

of the second quarter of the government’s fiscal year (i.e., January). PSC staff then begin

the assessment process.

- Using 15 key attributes used by services contractors who seek to make go / no-go decisions based on available information, one assessor reviews each agency’s forecast

and assigns point values in accordance with those attributes. Of note, each attribute is weighted in accordance with its relative importance to industry; PSC has vetted these attributes with contractors and government officials, as well as internally within PSC.

- Other PSC staff then conduct a “blind” reassessment process wherein they are unaware

of the score already assigned to an agency's forecast. This step encourages objectivity.

In the event of a discrepancy between the two assessments for a particular forecast,

the staff discuss their perspectives and resolve the discrepancy.

- Finally, PSC compares total scores of the assessed agencies side-by-side, determining the distribution of scores into Good, Fair, Needs Improvement, or Not Found. These cleavage points often “pop out” during the assessment process.

PSC’s 15 Key Attributes for a Successful Business Forecast

1. Searchable Spreadsheet

At a minimum, forecasts should be available in Excel format. Because PDFs are often difficult to read and sort, it is also difficult to extrapolate data; this complicates a potential bidder’s ability to identify opportunities. The use of a PDF may also indicate that the agency does not frequently update the forecast. PSC’s Federal Business Forecast team awards additional points for advanced Electronically Sortable Information (ESI) systems which go above and beyond Excel.

2. Date Modified

Agencies should indicate the last modification date for each opportunity. This informs users whether the information is recent or has changed since last viewing.

3. Forecast Update Frequency

PSC’s Federal Business Forecast team evaluates forecasts on frequency of publication. Agencies should update procurement forecasts at least twice a year.

4. Project Description and Contract Number

The PSC team evaluates forecasts on the existence and comprehensiveness of a project description and if the agency has assigned a contract number to the opportunity. To the greatest extent practicable, forecasts should include details on place of performance, type and scope of work, technical requirements, potential security clearance requirements, and other relevant opportunity-specific information.

5. Dollar Value (Base + Options)

The PSC team evaluates forecasts on whether the tool lists opportunity-specific dollar values, as well as the specificity of dollar values (e.g., base and option year values).

6. Program POC and COR Contact Information

Agency forecasts should specify a point of contact for each opportunity—with an individual’s (not generic or office) email address and telephone number. The PSC team awards additional points if the forecast tool indicates an individual point of contact and additional “back-up” points of contact.

7. Program Office & Buying Activity

PSC’s Federal Business Forecast team evaluates forecasts on whether they specify program office and buying activities for each opportunity.

8. PSC & NAICS Codes

When evaluating a forecast, the PSC team looks for specific NAICS and/or PSC code for each opportunity. Forecasts receive full points for including a NAICS code and PSC code, with partial credit awarded for having one, but not the other listed.

9. New Start or Recompete with Incumbent

Does the forecast specify the incumbent for each opportunity, or does it indicate which opportunities are new / have no incumbent?

10. Set Aside and Type

PSC’s Federal Business Forecast team evaluates whether the tool specifies set asides, and if so, what types (e.g., 8(a), WOSB, VOSB, etc.)

11. Contract Vehicle (e.g., IDIQ, BPA)

Forecasts should indicate a particular contract vehicle for each opportunity.

12. Action / Award Type

The team evaluates whether the forecast specifies each opportunity’s award type (e.g., competitive, sole source, multi-award) and contract type (e.g., fixed price, time and materials, incentive fee).

13. Anticipated Solicitation Release Date

Forecasts should specify the anticipated solicitation release date for each opportunity.

14. Anticipated Award Date�

Does the forecast specify the anticipated award date and / or fiscal year and quarter?

15.Anticipated Award Length

PSC’s Federal Business Forecast team evaluates whether the forecast includes award length.